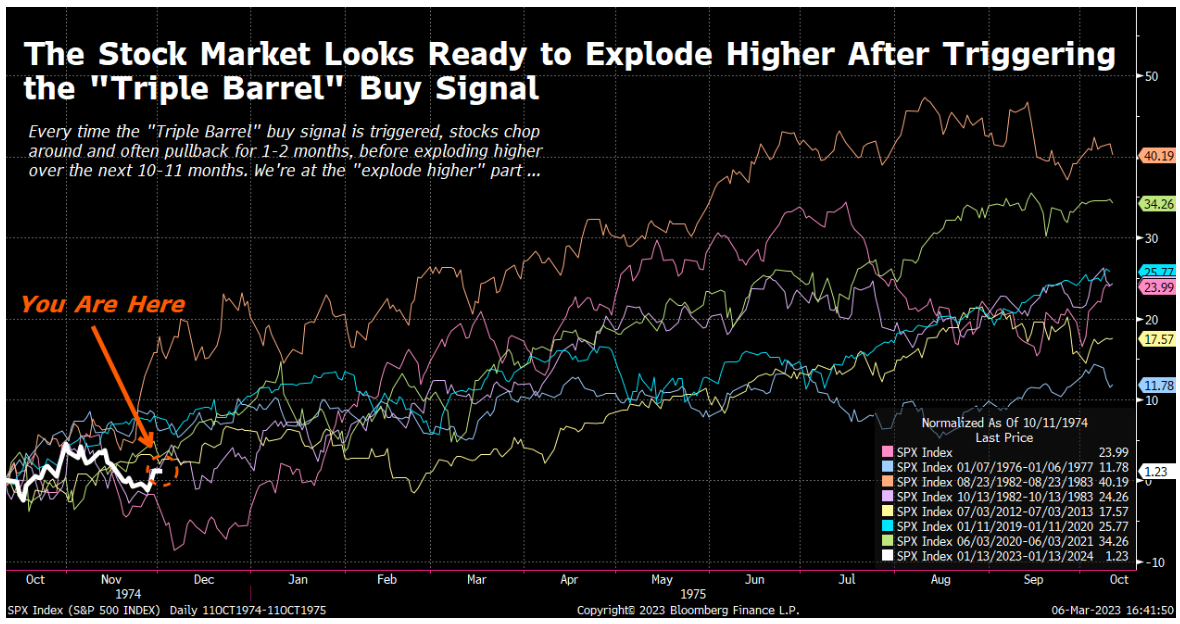

Back in January, the stock market did something it has never done before. And now, two months later, it could mean that stocks are ready to explode higher in a fashion they only do about once every 10 years.

On the second Thursday of the year – Jan. 12 – the stock market fired off an unprecedented “Triple Barrel” buy signal.

That is, on that day, three major, ultra-rare, and ultra-predictive stock market breadth thrust signals were all triggered – the Breakaway Momentum, Whaley Breadth Thrust, and Triple 70 Thrust indicators.

The Breakaway Momentum indicator is triggered when the number of 10-day advancing stocks in the market exceeds the number of 10-day declining stocks by about 2-to-1. This is very rare and tends to only happen when bear markets are ending and bull markets are starting.

The Whaley Breadth Thrust indicator is triggered when the number of five-day advancing stocks in the market exceeds the number of five-day declining stocks by about 3-to-1. This, too, is very rare and tends to only happen when bear markets are ending and bull markets are starting.

And the Triple 70 Thrust indicator is triggered when the percentage of rising stocks in the market exceeds 70% for three consecutive days. Likewise, this is also very rare. And it tends to only happen when bear markets are ending and new bull markets are starting.

All three ultra-rare, ultra-predictive “bear market ending” technical indicators flashed on the same day in the middle of January. Triple-Barrel Stock Indicators Preempt Mega RalliesThat’s the first time ever that all three have flashed on the same day.

In the past, we’ve only had “Double Barrel” buy signals – instances where two signals were triggered on the same day. That has happened just seven times since World War II.

In all seven instances, the stock market was higher three, six, nine, and 12 months later.

But there’s a catch: The stock market always fell first before it soared into a new bull market.

That’s because, in order to trigger multiple ultra-powerful breadth thrust signals, you need a lot of buying power. When you have a lot of buying power, you tend to push stocks into near-term overbought territory. And when stocks jump into near-term overbought territory, they tend to pull back a little.

In each of the seven times since WWII that the stock market triggered a “Double Barrel” buy signal, stocks suffered a pullback of at least 2% over the subsequent two months. On average, those pullbacks were about 6%.

Every time, stocks bottomed after the short-term pullback, then rallied over the next month… the next 4 months… and the next 10 months.

In other words, history says you don’t want to buy stocks immediately after a Double or Triple Barrel buy signal is triggered. It’s best to buy two months after the signal is triggered – once stocks have had time to cool down and right before a big face-melting rally starts.

And that’s exactly where we are today.

|

No comments:

Post a Comment