• Semiconductor stocks have been on a ferocious rally, rising by more than 20% year-to-date. Earnings estimates, however, have not managed to keep up, and that has led to more expensive valuations for chipmakers.

• The semiconductor industry is currently in a down-cycle. We expect sales growth to fall further in the coming quarters as the inventory correction continues.

• Down-cycles do not last forever, and sales will eventually recover to higher levels than before. The long-term structural trends that underpin semiconductor demand remain intact as well.

• The best buying opportunities come about during down-cycles. Even though valuations are not the cheapest at the moment, investors can consider building a position using a regular savings plan, before switching to lump-sum investments in the future.

• Our target price for the VanEck Vectors Semiconductor ETF is USD 317, which represents an upside potential of close to 26% as of 20 April 2023.

Lately, chip stocks have been on a ferocious rally. The VanEck Vectors Semiconductor ETF (NASDAQ:SMH) – a basket of 25 US-listed semiconductor stocks – has risen by more than 20% year-to-date, placing the semiconductor industry among one of the top-performing sectors this year (Figure 1). However, as earnings estimates have not been able to keep up with the surge in share prices, valuations for the sector have become expensive once more. This is a headache for those who have been sitting on the sidelines, waiting for an opportunity to take a position.

We are here to tell you that there are still ways for you to do so, but more importantly, remind investors why it is in your interest to always have this sector on your watch list.

Figure 1: Share prices of chipmakers have risen by about 20% since the start of the year

The semiconductor industry is currently in a down-cycle

On the whole, 2022 has been a superb year for the entire US chipmaking industry, with record-high revenues and double-digit earnings growth the norm for many players. Unfortunately, good times will not last forever and by the second half of the year, there were clear signs that the industry was sliding into a downturn.

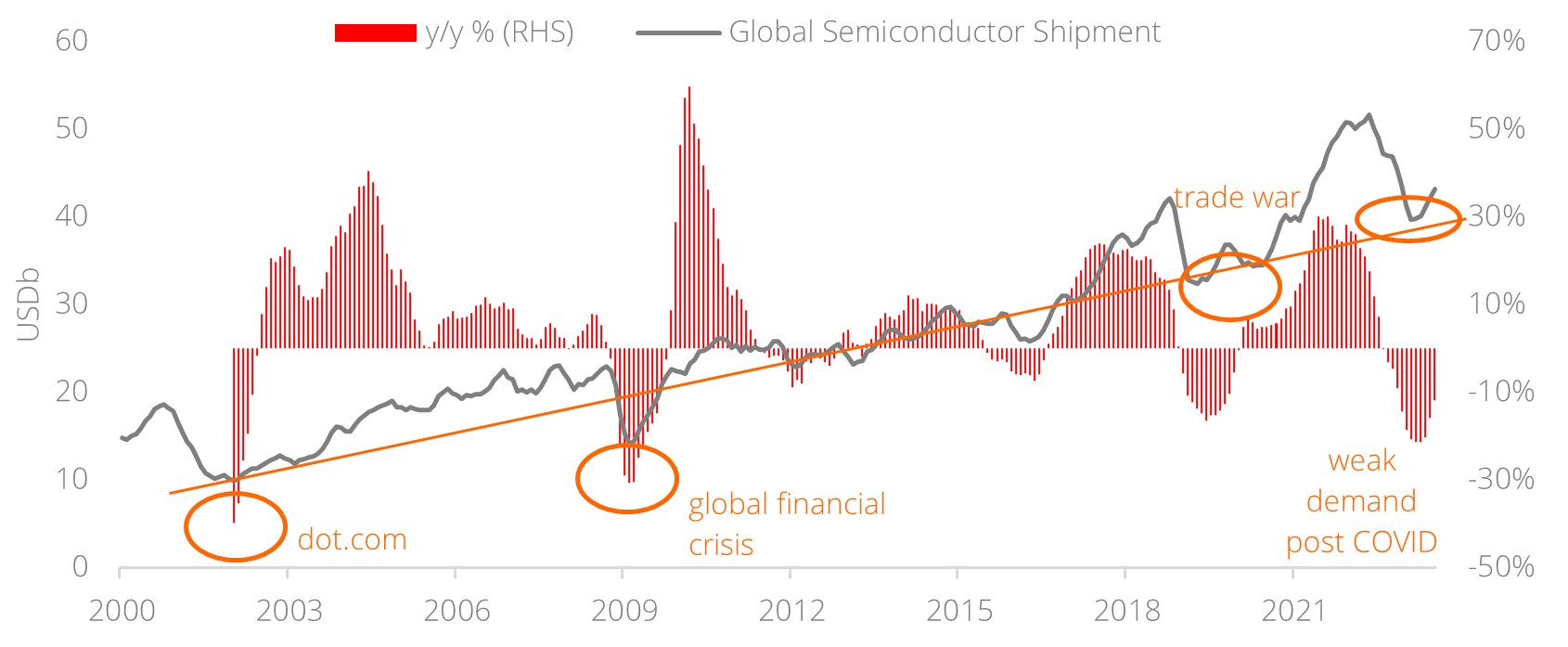

Most notably, semiconductor sales growth turned negative for the first time since 2019, falling by close to -10% in the fourth quarter of 2022 (Figure 2). If we look at things on a monthly basis, we can see that sales growth first turned negative in September, indicating that the down-cycle probably started way earlier. While the initial drop in sales was already significant, things will likely worsen over the coming quarters as the down-cycle plays out – which is bad news for semiconductor stocks.

Figure 2: Semiconductor sales fell by nearly -10% in the fourth quarter of 2022

While there are a number of reasons that can explain why sales growth has been falling, most can be linked to imbalances in supply and demand. As most people were stuck at home during the early days of the pandemic, trends such as remote working were starting to gain traction resulting in heavy demand for consumer electronics. Many businesses also used the pandemic as an opportunity to digitalise their operations. The end result is an unusually high demand for chips, so much so that it caused a shortage.

Facing pressure from governments and customers to alleviate the shortage, nearly all major chipmakers made commitments to expand capacity. As a matter of fact, the total industry capex grew by a staggering 26.7% CAGR in 2021 and 2022, significantly higher than the growth rate of 5.8% in the three years prior to the pandemic (Figure 3). Not surprisingly, this sudden and sharp increase in capex resulted in a supply glut. However, the timing could not be worse as this supply glut has come right when chip demand is dissipating rapidly, resulting in the down-cycle we are in today.

Figure 3: Huge surge in capex across 2021 and 2022 has resulted in a supply glut

Short-term pain for chipmakers as inventory correction continues

It is no secret that the economy today is on a much weaker footing compared to the beginning of 2022. Persistently high inflation, coupled with aggressive central bank policy, has slowed economic activity substantially, raising the risk of a recession. The recent collapses of Silicon Valley Bank and several other regional lenders are also evidence that tighter monetary policy is starting to bite, adding to concerns about the health of the economy.

Thanks to the greater economic uncertainty, chip demand has fallen drastically. Trapped between high inflation and borrowing costs, consumers have been cutting back on spending. According to data published by IDC, shipments of consumer electronics, such as PCs, smartphones, and wearables have all declined in 1Q23.

Among the various players, Apple’s Mac shipments plunged by more than -40% (the worst among the lot) as consumers traded down for cheaper alternatives. With the pandemic boom behind us and a global recession looming, shipments of consumer electronics are likely to remain weak for the foreseeable future.

To make matters worse, inventory channels are bloated, likely because many customers double-ordered during the shortage. Taking a quick look at the numbers for the top five chipmakers in the US, we can see that inventory days (the average number of days a firm takes to sell off inventory) and inventory-to-sales ratio have both been rising. Both measures indicate that turnover has been slowing (Figure 4).

Figure 4: Inventories have been rising among semiconductor companies as demand shrank

With demand falling and inventories rising, chipmakers will likely halt new orders and slash prices to get rid of excess inventory. Samsung said that it will meaningfully reduce production levels after a pileup in inventory and a collapse in memory chip prices caused the company to report the worst operating profit since the global financial crisis.

TSMC is also bracing for weaker sales by cutting its capex spending. The company expects first quarter revenue to be about -15% lower and operating margins to fall by about -10%. According to the management, this inventory correction will likely last throughout the year and things should start to pick up in 2024.

Related article: Running out of investment ideas? Here’s one that can bag you a 55% profit even in a recession

Down-cycles are temporary, long-term growth story remains intact

The good news here is that down-cycles do not last forever. Despite the current downturn, we are confident that semiconductor sales will eventually recover to higher levels than before as it had done so every single time in the past. Therefore, it is not a question of whether or not a recovery will occur, but rather a question of when will the recovery take place. By our estimates, we think that the industry could return to double-digit growth as early as 2024.

Figure 5: Semiconductor sales have always bounced back to higher levels than before post-downturn

According to estimates from McKinsey, the semiconductor industry is poised to become a trillion-dollar industry by 2030, which represents an annual growth rate of roughly 6-8%. Demand for chips is set to be driven by structural factors such as (i) an increase in the number of semiconductor applications, and (ii) the increase in silicon content in them.

These days, the use of semiconductors has become widespread. Recent innovations such as ChatGPT and the metaverse were only made possible because of advancements in semiconductor technology. Apart from this, the silicon content in most existing applications has also increased significantly over the years.

Take cars for instance. Even though they were still largely mechanical since the start of the 21st century, thanks to new innovations such as autonomous driving, the silicon content of cars today is estimated to have grown by more than five times compared to a decade ago, and is still expected to grow even further. According to projections by Intel, semiconductors will make up more than 20% of a vehicle’s cost by 2026, a fourfold increase from 2019!

The bottom line is this: as the world becomes increasingly tech-driven, chip demand will only become even stronger than before. This will bring immense benefits to the entire industry as a whole.

Downturns bring about the best buying opportunities

Down-cycles in the semiconductor industry come about once every few years. When they do, it is a buying opportunity not to be missed. While it is in our nature as investors to try and pick the exact bottom of the cycle, it is almost impossible to do so except in hindsight or with the help of sheer luck. Often, investors waiting to catch the cycle bottom end up missing out on the opportunity altogether.

So instead of trying to pinpoint where the bottom is, what we can do is identify a range of buying opportunities in the cycle. In our opinion, the best time to start accumulating semiconductor stocks is during the start of down-cycles, when share prices are falling and manufacturers are cutting back on production (such as now). As scary as things may seem today, down-cycles can be a great opportunity to pick up shares at a discount.

Figure 6: Downturns bring about the best buying opportunities

Source: iFAST

Even though valuations are not the cheapest at the moment and there is also the risk that share prices may tumble further, we believe that there is definitely long-term value within this industry. Stretching our investment horizon out further, valuations are not nearly as daunting as they are today – trading at just 15.8X 2025E EPS versus our fair PE multiple of 20X. This implies an upside of roughly 26%, and a target price of USD 317 for the VanEck Vectors Semiconductor ETF (NASDAQ:SMH).

Table 1: Valuations are not as daunting if investors think long-term

MVSMHTR Index | 2022 | 2023E | 2024E | 2025E |

Earnings Per Share (EPS) | 282.86 | 212.15 | 254.57 | 318.22 |

Earnings Growth YoY | 26.30% | -25.00% | 20.00% | 25.00% |

PE Ratio (X) | 14.40 | 23.73 | 19.78 | 15.82 |

Upside Potential (based on fair PE Ratio of 20.0X) | - | - | - | 26.40% |

Source: Bloomberg Finance L.P., iFAST Compilations. Data as of 20 Apr 2023 |

It is difficult to imagine a future without semiconductors.

For an industry with such solid fundamentals, the growth prospects are simply immense. While we understand that conservative investors may want to wait for more clarity before buying in, longer-term investors can start building a position today using a regular savings plan, before switching to lump sum investments should valuations fall further.

Alternatively, investors may also consider single-stock names such as TSMC (NYSE:TSM), which trades at lower valuations relative to the broader US semiconductor industry.

Figure 7: Share prices are driven by earnings in the long run