The Nasdaq-100 is home to 100 of the largest technology companies listed on the Nasdaq stock exchange. The index has a remarkable track record, delivering a positive annual return 78% of the time since its inception in 1985.

The tech sector is known for its high-growth nature, and so bearish periods in the Nasdaq-100 tend to be short-lived. The index has only declined in consecutive years on one occasion, and that was during the dot-com bust from 2000 to 2002. Since 2022 was a losing year, history bodes well for a (potentially strong) gain in 2023.

How strong? Here's what the rebounds looked like after losing years in 1990, 2008, and 2018:

YEAR | NASDAQ-100 RETURN |

|---|---|

1991 | 64.9% |

2009 | 53.5% |

2019 | 37.9% |

DATA SOURCE: SLICKCHARTS.

That's an average return of 52% in the year following a loss (excluding the 2000-2002 period).

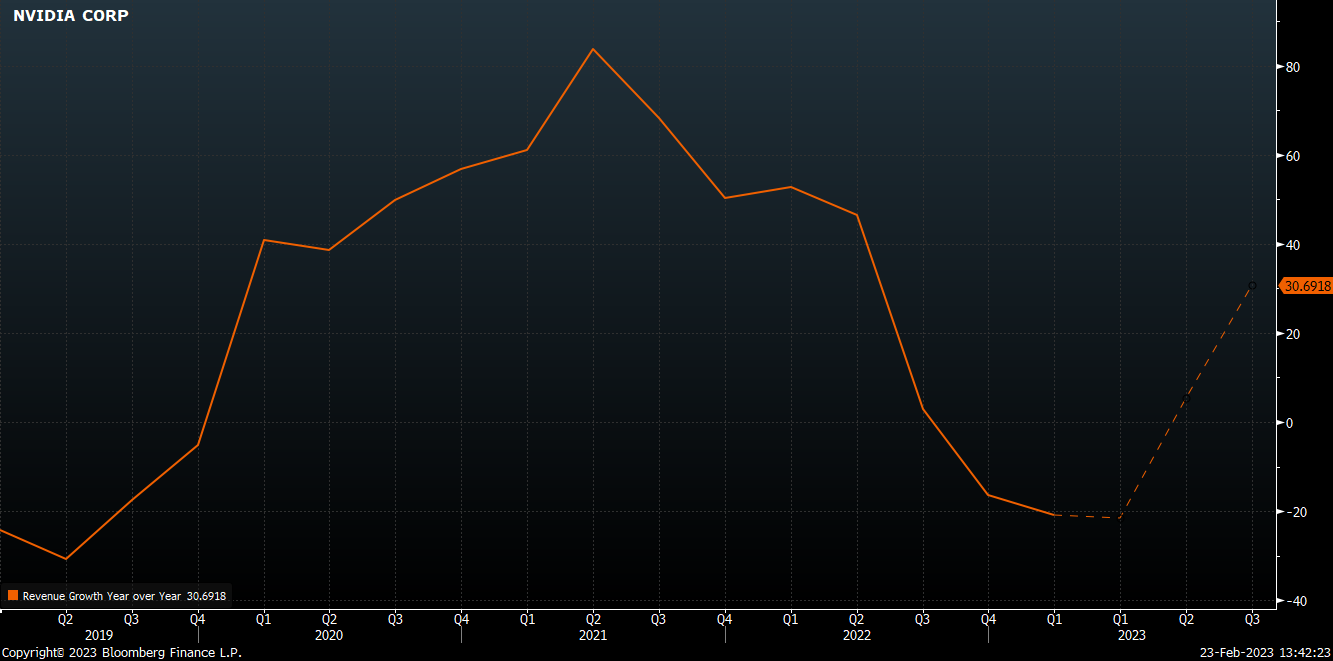

The semiconductor sector could be a big winner

No matter the device you're using to read this article, it's powered by advanced computer chips manufactured by the semiconductor industry. These pieces of hardware are growing increasingly important to everyday life. They're inside smartphones and computers we use, but they also drive the incredibly advanced data centers we normally don't see -- the facilities that host (and deliver) our digital experiences.

Consumers and businesses alike pulled back on their spending in 2022, which resulted in the chip sector underperforming the broader market. The iShares Semiconductor ETF plunged 35% for the year, faring marginally worse than the Nasdaq-100. But it has already gained 21% so far in 2023, and it could accelerate further as the economy -- and the stock market -- recovers. Longer-term, an estimate by Fortune Business Insights suggests the chip sector could be worth over $1.5 trillion annually by 2030.