Green shoots are starting to emerge in the end markets

- Global semiconductors shipments to experience further upside ahead

- Boom in AI driving demand for memory chips used by servers and data centres

- Green shoots appearing in end markets - bottoming PC shipments and improving mobile shipments

- Easing concerns on Tech's valuation premium amid recent upward earnings revision

- Preference for upstream companies offering stable mid-to long-term growth drivers

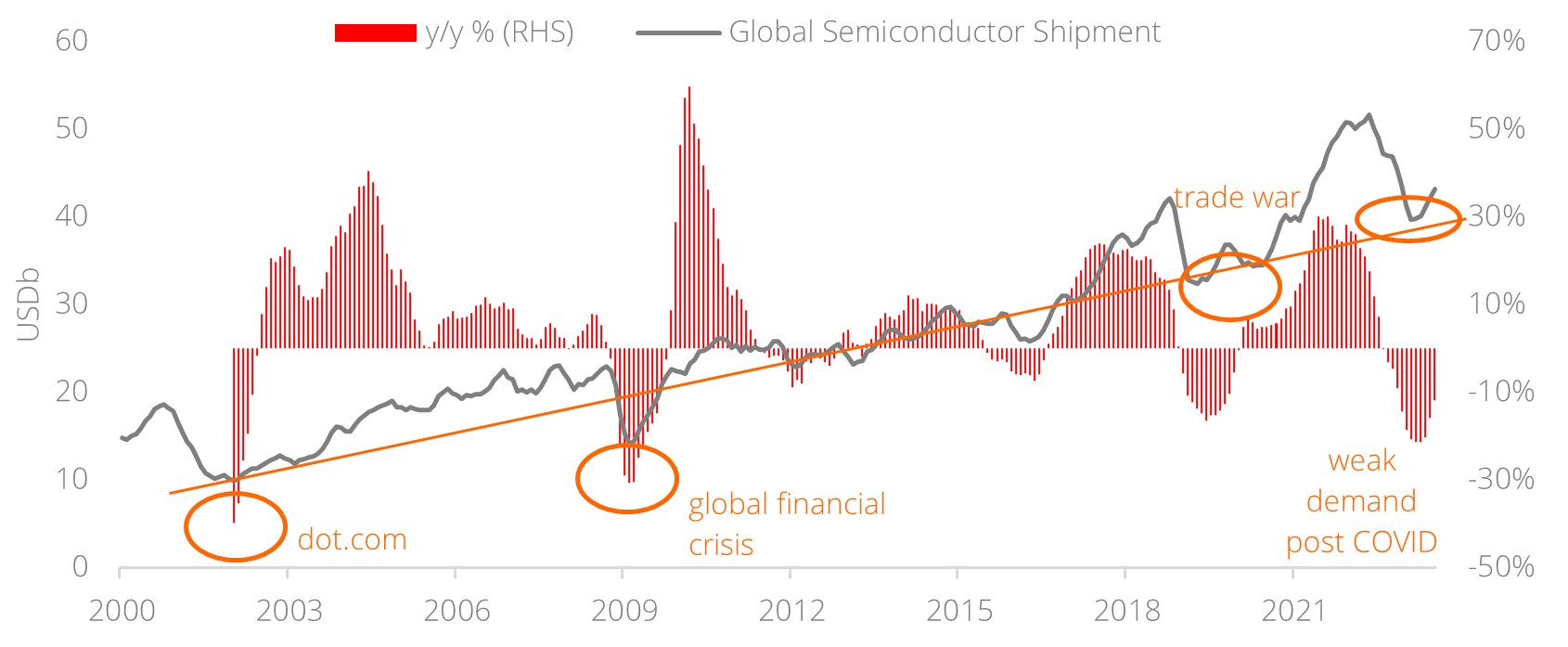

Global semiconductors industry on a recovery path. Global semiconductors shipment is on the rise and the drivers are:

- Bottoming of demand for memory chips: Demand for memory chips (previously the worst-hit) has bottomed and this segment is expected to lead the rebound for the semiconductors industry going forward. Artificial intelligence (AI) boom is driving demand for memory chips used by servers and data centres which require a large amount of memory capacity. For instance, an AI server possesses 6-8 times DRAM content as well as 3 times NAND content of a regular server.

- Positive flywheel effect through AI: The AI semiconductor segment is projected to grow at a CAGR of 22% in 2022-2027 (vs. 4.6% for the broader market). Apart from data centres, the other beneficiaries of AI include equipment makers and memory chip manufacturers. Every 1% increase in AI server penetration in data centres is expected to translate to USD1-1.5b of wafer fab equipment investment.

- Inventory destocking: Inventory destocking is on track and the process is expected to bring inventories back to normalised levels by 4Q23.

Green shoots sprouting for end markets; Improvement in macro outlook. Green shoots are starting to emerge in the end markets and they are: (a) 2Q23 saw sequential rebound in PC shipments (at +7.9% q/q) and this points to a bottoming of the PC market, (b) The decline in shipments for the mobile segment has narrowed compared to previous quarters, and (c) The server segment is seeing higher-than-usual GPU server shipments.

On the macro front, meanwhile, the outlook for electronics exports (in particular, for Singapore and Taiwan) is improving as well.

Preference for upstream semiconductors companies offering sustainable mid- to long-term growth. Prevailing market concerns on Tech’s valuation premium have eased amid recent upward earnings revisions, in particular for index heavyweights like Nvidia. This is a positive development given the tendency for valuation to either trade near or exceed its previous peak. Indeed, the sub-segments that registered sharp valuation expansion since the trade war include equipment makers, IDMs (integrated device manufacturers), and foundries.

On balance, we have a preference for upstream semiconductors companies offering stable mid- to long-term growth drivers.

Figure 1: Global semiconductor shipments bottoming

Source: Semiconductor Industry Association, CEIC, DBS