Semiconductor giant Nvidia (NVDA) saw its stock price jump almost 15% today. And a lot of folks can’t seem to understand why…

After all, its finances were a mess in its most recent earnings report. The chipmaker’s revenues dropped 21% in the quarter, while gross margins compressed by 90 basis points, operating profits fell 40%, net profits declined 35%, and per-share earnings slid 35%.

In other words, every key operational metric at the company dropped in the quarter. Yet, NVDA stock spiked! Why?

Because this is the bottom for all those key operational metrics.

Remember: Stocks trade on what will happen, not what has happened. They’re discounting mechanisms for the future. Investors look forward, not backward.

Looking backward, yes, Nvidia’s results were awful. Everything dropped.

But looking forward… things are going to get a lot better.

The semiconductor industry in which Nvidia operates is very economically cyclical. It moves with the economy. When the economy is booming, the semiconductor industry is booming, and Nvidia is growing. When the economy is contracting, the semiconductor industry (and by extension, Nvidia) is declining.

In 2022, the economy contracted, so semiconductors followed suit. Hence Nvidia’s bottoming sales and profits.

In 2023, however, the economy is expected to stabilize and even improve. If this proves to be a boon to the semiconductor industry, as is expected, then Nvidia’s sales and profits should rebound.

At least, that’s what Nvidia’s management team said on last night’s conference call. They sounded pretty optimistic that 2023 will be a lot better than 2022 for the chipmaker.

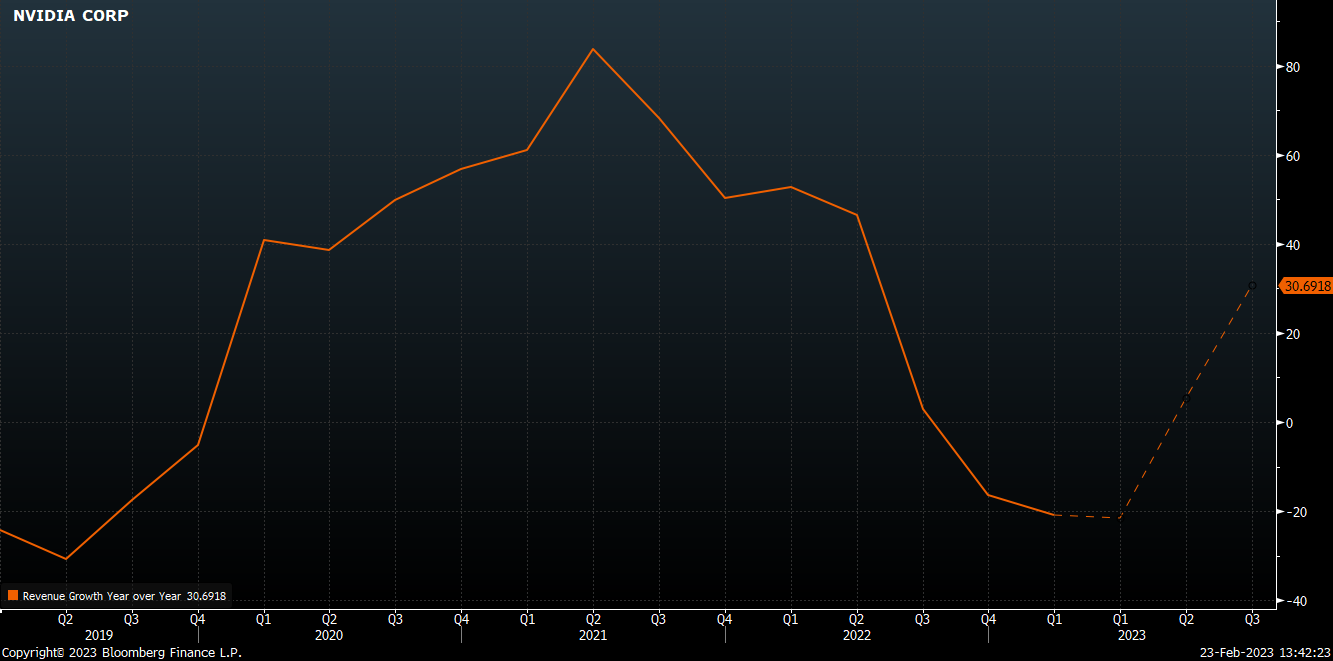

This is best illustrated in the following chart, which graphs Nvidia’s quarterly revenue growth rates. As you can see, revenue growth has been decelerating for several quarters now. But it’s expected to bottom this quarter and bounce back over the next few quarters.

This is important because the direction of the company’s revenue growth rates has historically determined the direction of Nvidia stock.

That is, whenever its revenue growth rates are falling, Nvidia stock tends to struggle. On the flipside, whenever its revenue growth rates are rising, Nvidia stock tends to rally.

See the chart below.

To that extent, we think Nvidia stock is in the early innings of a big comeback right now because its revenue growth rates are on the cusp of inflecting meaningfully higher.

That’s why we own NVDA stock in our Core model portfolio. It’s already up 534% for us, but we’re sticking with the rally because we see bigger gains on the horizon.

To be clear, this phenomenon of slowing revenue growth becoming re-accelerating revenue growth isn’t unique to Nvidia. It is happening to several companies right now.

(adpated from Luke Lango)

No comments:

Post a Comment