By now, you have probably read a lot of interesting interpretations of yesterday’s Federal Reserve meeting. It seems everyone in the financial world – and even outside of it – has an opinion about it and what it means for stocks.

Arguably the most popular interpretation is that the Fed is making a policy mistake.

That is, the failures of Silicon Valley Bank and Signature Bank – as well as the near-failures of First Republic (FRC) and Credit Suisse (CS ), and all the volatility in the stock prices of pretty much every regional bank – underscore that we’re in the midst of a big credit crisis.

Yet, while the Federal Reserve acknowledged that crisis yesterday, it still hiked interest rates. And Board Chair Jerome Powell sounded resolute in the Fed’s fight against inflation during the post-meeting press conference.

Therefore, many interpreted this move as the Fed being tone-deaf to the credit crisis. And that makes them believe the central bank will hike the U.S. economy right into a recession.

Those feelings were exacerbated when stocks, commodity prices, and Treasury yields all dropped yesterday. That’s a rare combination that typifies pre-recession behavior in the financial markets.

But…

What if this isn’t a policy mistake? What if the Fed knows exactly what it is doing here?

That’s my interpretation.

I think the Fed is purposefully “playing dumb.” And I think it’s a genius move that will ultimately allow for the creation of a new bull market.

The Federal Reserve Made a Genius Move

Simply consider this: The Federal Reserve hasn’t ever discussed “tightening credit conditions” during this rate-hike cycle. Yet, yesterday, Powell mentioned it about a dozen times in the post-meeting press conference. He kept saying over and over again that because of the bank failures, credit conditions are tightening.

Clearly, he wanted to emphasize to everyone that bank lending standards are tightening significantly.

Still, he kept saying that it is too early to say what these tightening credit conditions will do to inflation.

But anyone who has taken any economics class knows exactly what “tightening credit conditions” do to inflation: they kill it.

Tighter credit conditions mean it is harder to get access to capital. The harder it is to get access to capital, the less capital consumers and businesses have at their disposal. The less capital they have at their disposal, the less they spend. The less they spend, the lower inflation goes.

It’s not rocket science. It’s Economics 101.

You really think the seven voting members of the Federal Reserve don’t know this? You really think that a bunch of folks who are supposed to be the best economic minds in our country don’t know that big bank failures create significantly tighter credit conditions and kill inflation?

They know it.

But they can’t say it.

Getting the Best of Both Worlds

By enacting a policy of deliberate ambiguity, the Fed will get the best of both worlds.

We won’t get re-inflation because markets won’t run away with this idea that the “coast is clear.” Bloomberg’s Commodity Index dropped again yesterday and remains at its lowest level since Russia invaded Ukraine. And real-time inflation data from Truflation, which measures millions of data points and contrasts outdated government metrics, shows that inflation is collapsing toward 4% right now.

We also won’t get an economic collapse because the banks – or their depositors – won’t be overly fearful that the Fed is staying aggressive with rate hikes.

Instead, we will get rapid disinflation without a recession – which, perhaps uncoincidentally, is exactly what we’ve had over the past nine months.

Inflation peaked in June 2022. Since then, it has dropped more than 300 basis points. As it has, the unemployment rate has barely budged, and the economy has continued to expand.

What other Fed in history has cut inflation by 300 basis points without hurting the labor market?

Give this Fed credit. It knows what it’s doing.

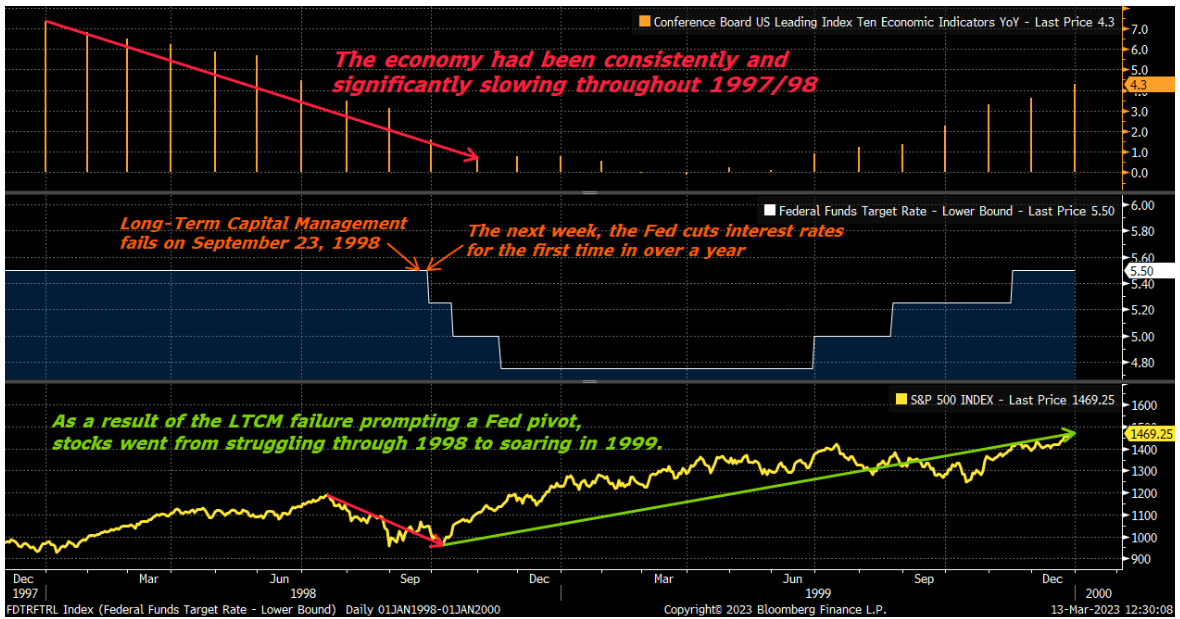

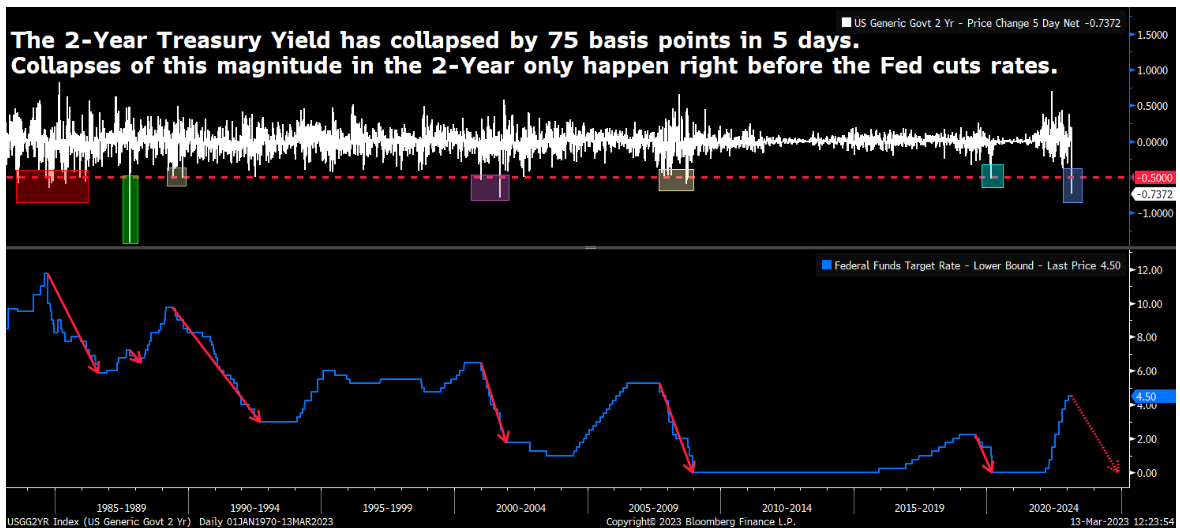

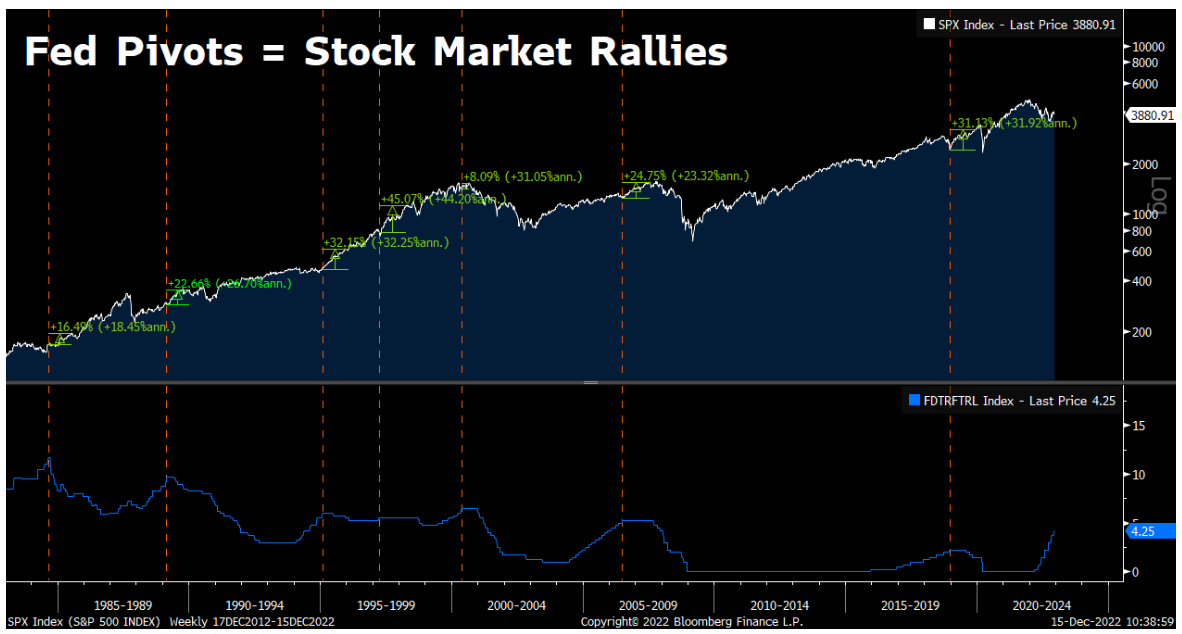

It’s done an awesome job so far, and it’s about to finish things up with a masterful final act by executing a policy of deliberate ambiguity until inflation collapses over the next few weeks. Then it’ll pivot fully dovish in May, pause rate hikes, and fully support the economy… and markets.

Long story short, this is a great buying opportunity.

The Fed’s fight with inflation is nearly over, and it’s figured out a way to finish this fight without knocking out the U.S. economy. Within months, inflation will be dead, the Fed will be on pause, the economy will be recovering, and stocks will be rebounding with vigor.

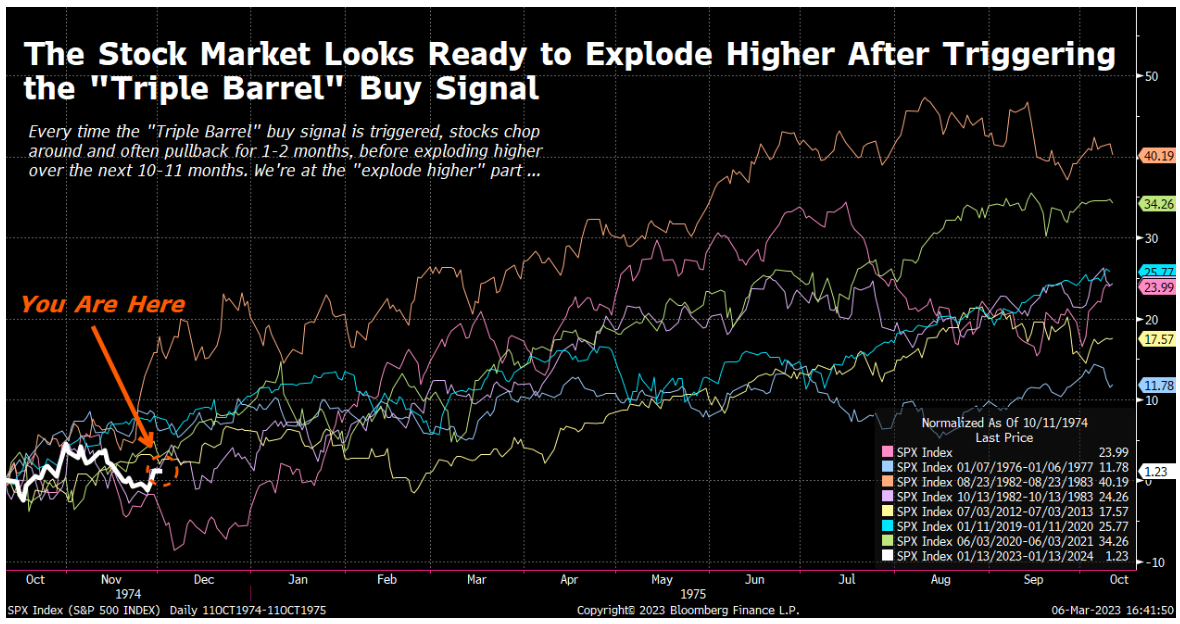

We believe this is the ninth inning of the bear market. Up next is the first inning of a prolonged, multi-year economic expansion and bull market.

This is buying time.

If you agree, find out what stocks you should be buying to prepare for this emerging bull market.

(Luke Lango)