The fourth-quarter earnings season is now in full swing. And so far, the numbers show that it’s been quite a strong quarter for many companies. But perhaps one of the strongest performances we’ve seen so far comes from one of our favorite long-term investments. Of course, I’m talking about fintech superstar SoFi (SOFI).

Now, I have to say that this Q4 earnings report was fantastic across the board. But one of the most exciting things to note here is that SoFi has achieved profitability for the first time since its initial public offering in 2021.

The fintech superstar reported $48 million of net income in Q4, far surpassing analysts’ average estimate of $9.9 million. And with adjusted net revenue clocking in at $594.2 million, SoFi beat those average estimates by more than $20 million.

Not to mention, the firm reported $18.6 billion in total deposits for this past quarter, up from $7.34 billion in 2023. We’re talking about a 150%-plus increase in total deposits year-over-year.

All this has gotten investors head-over-heels for the fintech darling. And since it reported quarterly results, SoFi stock has rocketed nearly 20%!

We think this party is probably just getting started.

That’s because, phenomenal earnings aside, SoFi has the fundamental backbone it needs to take over the fintech world. And that means it has great potential to make investors quite a pretty penny.

We honestly believe investors who buy and hold enough SoFi stock today could turn into millionaires over the next few years.

Here’s the complete story.

Banks Suck, But SoFi Solves the Problem

Hardly anyone likes the legacy banking process.

Think about account fees, clearinghouses, high interest rates, broken digital experiences, confusing rewards programs, long phone calls and in-person appointments. The entire process is slow, expensive and cumbers

So… what if technology bypassed those middlemen profiteers? What if someone created a digital bank with technology-driven processes that delivered fast, cheap, and convenient solutions to customers everywhere?

That’s what SoFi is doing.

SoFi was founded in 2011 by Stanford business school students fed up with the inefficiencies of the student loan industry. They saw a huge opportunity to fix those inadequacies, which they recognized were rooted in two things.

One – at the time, banking was a physical-first industry. And therefore, it was weighed down by property-related expenses that were inevitably passed onto the consumer.

Two – student loans were typically structured as complex transactions with tons of middlemen. And all had their own fee that the college student had to pay.

So, SoFi was created on the idea of leveraging automated technologies to create hyper-convenient access to cheap student loan refinancing.

And it worked.

Over the past decade, students across America have flocked to SoFi to refinance their loans, taking advantage of its lower rates. Those rates have been achieved using technologies to reduce the operating costs of the business. And SoFi has, of course, passed those cost-savings onto students.

That was the “hero product” that put SoFi on the map in the fintech world.

SoFi has since leveraged this success story to build an ecosystem of high-quality, low-cost, and hyper-convenient fintech solutions. And all are accessible through its single, intuitive “super app.”

The SoFi Super App

Through the SoFi app, the company offers:

- SoFi Money: a cash management account that acts like a mobile checking or savings account. It has no account fees, 1% APY and an attached debit card.

- SoFi Invest: an attached mobile investing account. In it, consumers can use their funds from SoFi Money to invest in stocks, ETFs and cryptocurrencies. They can also invest in pre-IPO shares, which are usually reserved for institutional clients.

- SoFi Credit Card: an attached credit card. Consumers can link their Money accounts to this card and earn 2% cash-back on all purchases. Those rewards can be used to pay down debt through a SoFi loan or invest in stocks/cryptos with SoFi Invest. And there’s no annual fee.

- SoFi Relay: an attached budgeting software tool. Consumers can use it to track and monitor spending via SoFi accounts and external linked bank accounts. They can also check their credit score.

- SoFi Education: complementary educational articles and videos that help consumers learn everything about finance. It covers topics from how to invest in cryptos, to what an APR is, to why credit scores matter.

With the SoFi app, you get all those things… in one application. It’s an all-in-one mobile money app that’s leveraging technology to make banking fast, cheap and easy.

It’s the future – which is why we see this stock as such a winning bet.

Why SoFi Will Win the Digital Finance War

Now, to be sure, SoFi is not alone in its pursuit to reinvent the consumer finance experience. Entrepreneurs and venture capitalists have long realized that consumer banking sucks and needs to be digitized to be improved. To that end, there are lots of digital finance apps out there attempting to be the “Amazon of Finance.”

But in this digital finance war, SoFi stands superior with clear competitive advantages to sustain its leadership.

Most other apps in this space are barely breaking a few hundred thousand users (if that) with tiny revenue streams. That’s not true for SoFi.

SoFi has more than 7.5 million members on its platform. And it’s been growing that number by 500,000-plus new members every single quarter (44%-plus year-over-year growth).

Currently, SoFi is the unrivaled leader in the digital finance war.

And we don’t think this will change anytime soon. It seems SoFi has durable competitive advantage, which should allow it to turn into the “Amazon of Finance.”

The Team

First, there’s the team. Great people make great products. If there are great people on your team, your company will likely make great products that consumers consistently return to.

SoFi has the best team in all of finance. The CEO was CFO at Twitter (TWTR). Before that, he was the head of global banking at Goldman Sachs (GS). And that’s a position he held after being CFO of the NFL. He’s an impressive person, to say the least.

SoFi’s CFO is a former Uber (UBER) finance executive. Its CMO used to head up global corporate marketing at Intuit (INTU ). SoFi’s president was formerly the president of USAA Bank. The chief risk office held the same position at Citibank (C). And the product head used to be the VP of Amazon’s Alexa shopping group.

SoFi’s employee base includes former Wells Fargo, Goldman Sachs, Citi, JPMorgan (JPM) and Bank of America bankers and analysts. Another 160-plus employees hail from Amazon, Apple (AAPL), Microsof

This is the dream team. If any collection of folks can figure out how to create the “Amazon of Finance,” it’s this group.

Network Effects

Second, you have network effects. SoFi benefits from viral network effects both for in-app engagement and new-user acquisition.

In terms of in-app engagement, SoFi has successfully created a growth flywheel. Consumers join SoFi for one of its products and, over time, are attracted to and eventually adopt multiple products. This growth flywheel promotes durable average-revenue-per-user growth.

And with respect to user acquisition, SoFi is such a loved product that consumers rave about it to their friends. Through this word-of-mouth recommendation loop, SoFi has been able to grow like wildfire with minimal marketing costs. Case-in-point: I was the first to adopt SoFi in my social circle. I raved about it. Most of my friends tried it. And now it’s the most used personal finance app in my crowd.

That dynamic is playing out everywhere, every day. It creates a pathway for durable user growth.

Durable user growth combined with durable average-revenue-per-user growth, on top of a talented team that will only make this product better over time, means that SoFi realistically projects as the bank of the future.

And if that happens, SoFi stock will rattle off some enormous gains from current levels.

The Math to Fat Gains in SoFi Stock

By our numbers, SoFi stock has a realistic pathway to 21X your money – if you buy today!

According to the U.S. Census Bureau’s 2023 population estimates, the U.S. population currently measures around 335 million people. As of 2020, the total population of folks 18 and older measured 78%. We believe about 20% of those people could be SoFi members by 2030, which would imply a member base of ~52 million people.

We also think most users will employ about three products (Money, Credit Card and Invest), implying around 156 million total products used. And we estimate that average revenue per product at that time will be about $200. Assuming so, that puts 2030 revenue at over $31 billion.

And according to its recent earnings results, SoFi has achieved 30% EBITDA margins. Assuming that remains true, we believe net profits could eclipse $9.3 billion by 2030.

Based on a simple 20X price-to-earnings multiple, that implies a 2030 valuation target for SoFi of over $186 billion. That’s up around 21X from today’s $8.7 billion market cap.

So, if SoFi does indeed turn into the “Amazon of Finance,” we think its stock has 21X upside potential from current levels.

And per our analysis of the products and the team, we think SoFi stands a great chance at success.

So… what’re you waiting for? Pile into SoFi stock before it reaches outer space.

The Final Word

As the saying goes, where there’s disruption, there’s opportunity. And when it comes to the fintech industry, no one’s shaking things up like SoFi.

That means this superstar holds some major potential. So, if you’re a long-term investor hoping to mint serious wealth, you may not find a better opportunity than SOFI.

Though, fintech isn’t the only sector experiencing a seismic shift.

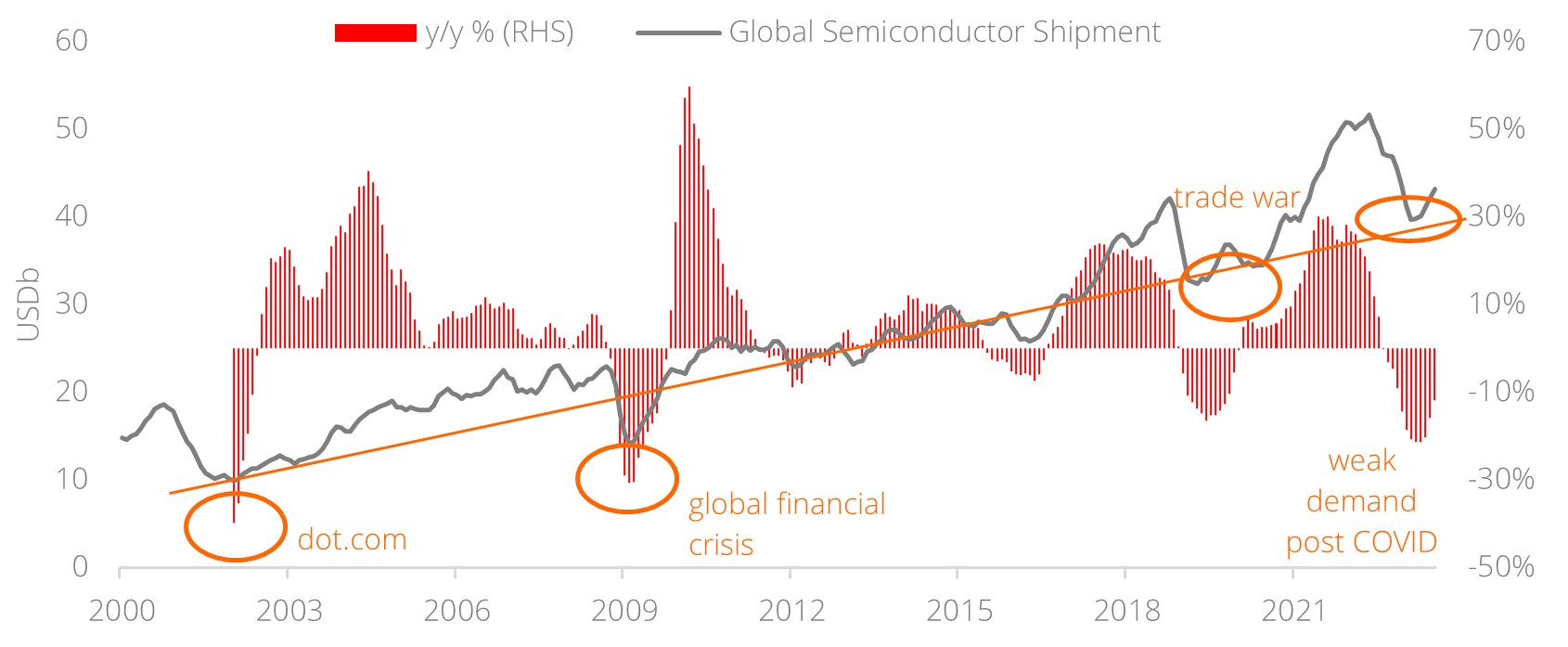

Thanks to the emergence of next-gen AI technology, we’ve entered a new era of investment: the AI Boom. And over the past year, as artificial intelligence has progressed at a rapid pace, all-things AI have exploded in popularity: including top AI stocks.

We’re confident this new AI-driven bull market will persist throughout the rest of the decade. But certain stocks will rocket much more furiously than others.

(Luke Lango)

Verdict: Sofi could contribute to my retirement in a big way. But it is a wild card, and I will only buy small amounts. I will buy for keeps till the end of this bull market, anticipated to be end 2025.